Financial Performance

Financial Highlights FY 2024-25

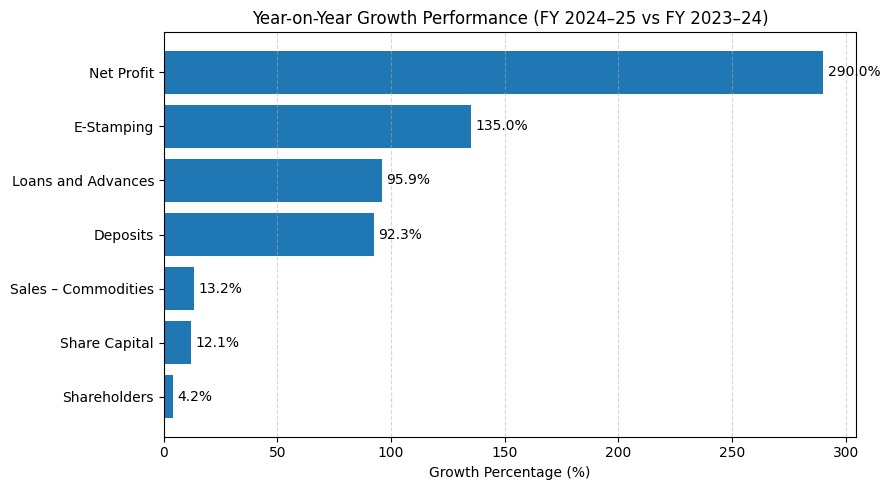

Key Metrics:

| Particulars | 31-03-2025 | 31-03-2024 | Growth % |

|---|---|---|---|

| Share Capital | Rs. 17.90 lakhs | Rs. 15.98 lakhs | 12.1% |

| Sales – Commodities | Rs. 39.46 lakhs | Rs. 34.84 lakhs | 13.25% |

| Deposits | Rs. 7.01 crores | Rs. 3.64 crores | 92.33% |

| Loans and Advances | Rs. 5.34 crores | Rs. 2.72 crores | 95.93% |

| E-Stamping | Rs. 7.44 crores | Rs. 3.15 crores | 135% |

| Net Profit | Rs. 5.65 lakhs | Rs. 1.45 lakhs | 290% |

| Shareholders | 724 | 695 | 4.17% |

Business Performance Analysis

- Banking & Financial Services: The deposit position increased from Rs. 3.64 crores to Rs. 7.00 crores - a remarkable 92.33% growth. Loans and advances reached Rs. 5.34 crores, representing 95.93% growth year-over-year.

- E-Stamping Success: The e-stamping business achieved phenomenal growth with turnover reaching Rs. 7.43 crores in FY 2024-25, representing 135% growth. Daily transactions range from Rs. 100 to Rs. 9 lakhs.

- Trading Operations: While trading activities were subdued due to competitive pressures, the society maintained existing client relationships with sales of Rs. 39.46 crores.

- Profitability: Net profit grew by 290% from Rs. 1.45 lakhs to Rs. 5.65 lakhs, demonstrating operational efficiency and strong business fundamentals.

Dividend Declaration

FY 2024-25: 11% dividend on share capital

- Second consecutive year of dividend distribution

- Reflects strong balance sheet and operational performance

Deposit Composition

- Fixed Deposits: 51% (Rs. 3.57 crores)

- Sampoorna Samridari Patra: 28%

- Cash Certificates: 7%

- Recurring Deposits: 2%

- Current Accounts: 5%

- Term Deposit Schemes: 14%

- Others: 2%